CYBERPOL LAUNCHED eLEARNING & ONLINE CERTIFICATIONS

Get Certified today (CyberPOL Cyber Essentials Certification)...

The Cyber Risk Management Certifications and Assessment can help you comply with GDPR and is an absolute necessity if you are under GDPR regulations compliance.

CYBERPOL Partnership Training Programs in accreditation with CYBERPOL The International Cyber Policing Organization approved by Decree (D-U-N-S Number 371018431). They provide four basic cyber training modules ranging from €499 to €1299 per certification in which the candidates on completion receives the certification, in some cases valid for one year and must be renewed annually.

The Accreditation QA (Quality Assurance) is in accordance with the use of accreditation class 42 of the trademarks act for academicals purposes. Thus ensuring such certification can only be issued by the license holders of such certifications.

Who Should Attend

All those wishing to act the Role of DPA/CSO/SSO/ IT manager along with all Personnel involved in IT & OT systems.

The following courses:

1. CyberPOL Cyber Essentials Cyber Security Essentials Awareness Training - Level I (SYBC1)

2. CyberPOL Cyber Essentials Cyber Security Essentials Awareness Training - Level II (CYB2)

3. CyberPOL Cyber Essentials PCI Compliance Security Awareness Training - Level I (CYBCPCI1)

4. CyberPOL Cyber Essentials PCI Compliance Security Awareness Training Level II (CYBPCI2)

5. CyberPOL Cyber Essentials Cyber Security Awareness Certifications and re-certifications ( coming soon)

6. CYBERPOL HIPAA Compliance Security Awareness Training (CYBHIPAA)

Accreditation By CYBERPOL The International Cyber Policing Organization by Decree and endorsed by ECIPS The European Centre for Information Policy and Security.

Policy and Compliance

Regulatory Reference: BIMCO Guidelines on Cyber Security, EU Regulation 2016/679, IMO MSC-FAL.1/Circ.3, ISO 27032:2012, Policy Letter 08_2016, TMSA, UK Department of Transport Code of Practice Cyber Security for Ships, USCG Cyber Security Strategy, GDPR.

All courses are European Centre for Information Policy and Security (ECIPS) endorsed.

Source: CyberPOL Academy.

Source: European Centre for Information Policy and Security (ECIPS).

IFZ FINTECH STUDY 2018 AN OVERVIEW OF SWISS FINTECH

The Swiss fintech market grew by 62 percent in 2018, according to a recent study by the Lucerne University of Applied Sciences published on February, 27.

In the IFZ FinTech Study 2018 of the Lucerne University of Applied Sciences and Arts, the project team provides a comprehensive overview of the Swiss FinTech sector.

The entire 140 page study can be downloaded free of charge from Swiss Bankers Prepaid Services Ltd.

Source: Swiss Bankers.

INITIAL COIN OFFERINGS (ICO'S) FOR SME FINANCING

15 January 2019 - Initial Coin Offerings (ICOs) are one of the most prominent applications of blockchain for finance, allowing for an innovative and inclusive way of financing small and medium-sized enterprises (SMEs).

Although the lack of regulatory clarity currently exposes ICO participants to some risks, appropriately regulated and supervised ICOs offer a potential new way to raise capital for projects enabled by Distributed Ledger Technologies and the blockchain.

This report analyses the emergence and potential of ICOs as a financing mechanism for start-ups and SMEs, examines the benefits and challenges of this mechanism for small businesses and investors, and discusses the policy implications of ICO activity for the inclusive financing of SMEs and the real economy...

Source: OECD.

SAFETY AND SECURIT COMMITTEE TALKS ABOUT PREVENTING BUSINESS RISKS, ACCESS CONTROL OPTIONS AND CRYPTOCURRENCY RELATER CRIME

February 14, 2019. AmCham SPb News and Events...

The meeting featured three presentations by Igor Bederov, Internet-Rozysk, Yuri Ivanov, Hyundai Motors and by Alexander Podobnykh, SICP and convened around 20 security specialists from member companies.

Presentations:

1. Risks prevention at the first contact stage. What can contact details reveal? (in Russian).

2. Access control and access management systems: new technologies in security provision (in Russian).

3. Prevention and investigation of crypto currency turnover related crime (in Russian).

Source: AmCham Russia.

BLOCKCHAIN TECHNOLOGY DIGEST: JANUARY 2019

Mind Smith has prepared an overview of key materials, analytical reports, research, reports and research articles. All the most interesting in the industry for the month...

37 analytical studies and reports, 27 scientific articles, 5 documents of international organizations.

Since 2018, Mind Smith has been implementing strategic blockchain consulting. Helps answer the question about the use of technology blockchain in business, conducts research and strategic sessions for top managers.

The company believes in the blockchain technology, but understand its limitations. For effective implementation of a well-coordinated work of the business and technical team. Mind Smith is ready to go all the way from the search for possible scenarios and the preparation of the concept to the implementation of the pilot and the implementation of the solution in the business.

THE STATE OF EUROPEAN TECH 2018

We are proud to present the single, most comprehensive data-driven analysis on European technology today.

What’s changed for European tech in the past 12 months? It’s been another record year for investment in European tech and the sector is powering growth in Europe’s stagnant economy. Yet not everyone is benefitting from the boom. The gains are not being democratized by investors. Companies need to address diversity and inclusion tools and unlock hidden talent pools.

This is the fourth edition of the State of European Tech report, the single, most comprehensive data-driven story of European technology today. We’ve gathered data from world-class data partners and a survey of 5,000 members of the tech ecosystem, from founders to students, investors to researchers. We’ve tried to tell the most important stories. We cover diversity and inclusion, talent, regulation, investment, research and development, and the great, global disrupters out of Europe...

Source: State of European Tech 2018.

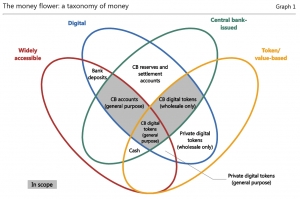

PROCEEDING WITH CAUTION - A SURVEY ON CENTRAL BANK DIGITAL CURRENCY: BIS

On January 8, Bank For International Settlements released BIS Papers № 101, written by By Christian Barontini and Henry Holden.

The hypothetical benefits and risks of central bank digital currencies are being widely discussed. This BIS paper adds to these discussions by taking stock of how progress and plans in this area are developing, based on a global survey of central banks. Responses show that central banks are proceeding with caution and most are only at a conceptual stage with their work. However, a handful have moved to considering practical issues and a couple of central banks with idiosyncratic circumstances might issue a digital currency in the short or medium term.

Source: Bank for International Settlements.

UNITED KINGDOM'S MEASURES TO COMBAT MONEY LAUNDERING AND TERRORIST FINANCING

Paris, 7 December 2018 - The United Kingdom has a well-developed and robust regime to effectively combat money laundering and terrorist financing. However, it needs to strengthen its supervision, and increase the resources of its financial intelligence unit.

The FATF has conducted an assessment of the United Kingdom’s anti-money laundering and counter terrorist financing (AML/CFT) system. The assessment is a comprehensive review of the effectiveness of the UK’s measures and their level of compliance with the FATF Recommendations.

The UK is the largest financial services provider in the world. As a result of the exceptionally large volume of funds that flows through its financial sector, the country also faces a significant risk that some of these funds have links to crime and terrorism. This is reflected in the country’s strong understanding of these risks, as well as national AML/CFT policies, strategies and proactive initiatives to address them.

The UK aggressively pursues money laundering and terrorist financing investigations and prosecutions, achieving 1400 convictions each year for money laundering. UK law enforcement authorities have powerful tools to obtain beneficial ownership and other information, including through effective public-private partnerships, and make good use of this information in their investigations. However, the UK financial intelligence unit needs a substantial increase in its resources and the suspicious activity reporting regime needs to be modernised and reformed.

The country is a global leader in promoting corporate transparency and it is using the results of its risk assessment to further strengthen the reporting and registration of corporate structures. Financial institutions as well as all designated non-financial businesses and professions such as lawyers, accountants and real estate agents are subject to comprehensive AML/CFT requirements. Strong features of the system include the outreach activities conducted by supervisors and the measures to prevent criminals or their associates from being professionally accredited or controlling a financial institution. However, the intensity of supervision is not consistent across all of these sectors and UK needs to ensure that supervision of all entities is fully in line with the significant risks the UK faces.

The UK has been highly effective in investigating, prosecuting and convicting a range of terrorist financing activity and has taken a leading role in designating terrorists at the UN and EU level. The UK is also promoting global implementation of proliferation-related targeted financial sanctions, as well as achieving a high level of effectiveness in implementing targeted financial sanctions domestically.

The UK’s overall AML/CFT regime is effective in many respects. It needs to address certain areas of weakness, such as supervision and the reporting and investigation of suspicious transactions. However, the country has demonstrated a robust level of understanding of its risks, a range of proactive measures and initiatives to counter the significant risks identified and plays a leading role in promoting global effective implementation of AML/CFT measures.

FATF adopted this report at its Plenary meeting in October 2018...

ARTICLES ON SECURITYLAB.RU

The leading information security portal SecurityLab.ru has published a note: CipherTrace - audit trail encryption (2018/12/16).

For the first 9 months of 2018, theft in the cryptocurrency industry reached about $ 1 billion...

The October report by CipherTrace shows that the criminals used bitcoin to launder $ 2.5 billion of dirty money. Thus, 380 000 BTC was laundered on cryptocurrency exchanges.

A new study showed that 97% of criminal bitcoins flow into unregulated cryptocurrency exchanges.

Bitcoin's anonymity is a stumbling block for many, almost from the day it appeared. Despite the fact that a number of politicians and experts consider the first digital money to be completely anonymous, yet this is not true. To make a bitcoin transaction, you do not need personal data and the user's address, but information about all operations remains in the public distributed registry. This may allow you to track cash flow.

There are measures that can increase the anonymity of translations. For these purposes, services have been developed - cryptocurrency mixers. For example, you can convert Bitcoin to other cryptocurrencies, and then back. However, even such methods do not make the first cryptocurrency completely confidential. Both the sender and receiver can still be calculated.

It is noteworthy that at the moment, many state and commercial companies have attended to the identification of users. They make a lot of effort to master the methods of computing the identities of those who make suspicious transfers. Therefore, it’s impossible to talk about complete anonymity on the Bitcoin network...

Source: SecurityLab.ru

Source: K4Y0T Project.

BLOCKCHAIN THREAT REPORT: MCAFEE

Blockchain, a revolutionary basis for decentralized online transactions, carries security risks. Learn about current security problems and specific incidents within blockchain implementations, and the techniques, targets, and malware used for attacks.

What spiked the movement, starting in fall 2017, toward cryptojacking? The first reason is the value of cryptocurrency. If attacker can steal Bitcoins, for example, from a victim’s system, that’s enough. If direct theft is not possible, why not mine coins using a large number of hijacked systems. There’s no need to pay for hardware, electricity, or CPU cycles; it’s an easy way for criminals to earn money. We once thought that CPUs in routers and video-recording devices were useless for mining, but default or missing passwords wipe away this view. If an attacker can hijack enough systems, mining in high volume can be profitable. Not only individuals struggle with protecting against these attacks; companies suffer from them as well...

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su