FUNCTIONAL TESTING SICP COMMUNITY

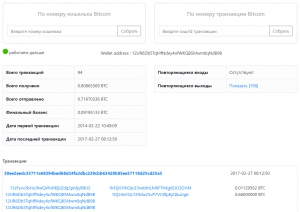

Launched a pilot project of the service of evaluating the reliability of cryptowallets and conducting investigations of crimes committed using cryptocurrency.

We invite an active expert community to take part in testing the functional, discussing the sources of events, as well as questions of the legal significance of the evidence collected.

Suggestions (complaints, statements) are accepted in the comments below, to the official mailbox (This email address is being protected from spambots. You need JavaScript enabled to view it.), or you can use the official contact form on the website...

The most active participants will be presented for the award of internal tokens of the SICP platform.

More details: sicp.ueba.su

CRYPTOCURRENCY ANTI-MONEY LAUNDERING REPORT - Q3 2018

CipherTrace Third Quarter Report proves cryptocurrency anti-money laundering laws are effective, and cites $927 million of cryptocurrency stolen during 2018 that needs to be laundered.

Ninety-Seven Percent (97%) of Criminal Bitcoin Flows into Unregulated Cryptocurrency Exchanges According to New Research...

October 10, 2018 – Efforts to enact and enforce strong cryptocurrency Anti-Money Laundering (AML) regulations are drastically reducing criminal activity on digital currency exchanges, according to new research released today in the CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report. The study revealed that 97 percent of direct bitcoin payments from criminals went to exchanges in countries with weak anti-money laundering laws.

Nearly five percent of all bitcoin sent to poorly regulated exchanges comes from criminal activity before the money is moved, undetected, into the global financial payments system. In fact, these exchanges have laundered a significant amount of bitcoin, totaling 380,000 BTC or $2.5 billion at today’s prices.

The report covers the latest legislative changes, as governments around the world are ramping up cryptocurrency AML regulation and enforcement, many by the end of this year. For example, US FinCEN recently clarified its stance on regulation, subjecting crypto-to-crypto exchanges to the Bank Secrecy Act (BSA) rules, focusing on mixing services and enlisting the help of the IRS. The European Commission’s 5th Anti-Money Laundering Directive (AMLD 5) was also entered into force in July and will require G20 nations to comply with strict AML regulations. “Different geographies are competing on regulations and trying to become ‘trusted’ digital currency hubs in order to grow their economies,” added Jevans.

During the first three quarters of this year, the report shows $927 million of cryptocurrency reported as stolen from exchanges. The $166 million in reported thefts since the second quarter report was driven by an emerging trend toward more frequent and smaller cyberattacks by sophisticated thieves. CipherTrace estimates that total stolen cryptocurrency reported is expected to hit well over $1 billion by the end of the year – currency that needs to be laundered.

The CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report provides an in-depth state-of-the-market look at criminal activity and the status of AML regulations by jurisdiction. The report presents an unprecedented quantitative analysis of 45 million transactions at 20 top cryptocurrency exchanges globally between January 2009 until September 20, 2018, and identifies criminal funds from dark markets, extortion, malware, mixer/tumbler/money laundering sites, ransomware, and terrorist financing.

Source: CipherTrace.

DRAFT-LAW ON TRANSACTION SYSTEMS BASED ON TRUSTWORTHY TECHNOLOGIES (BLOCKCHAIN ACT)

Summary of the Consultation report on the Blockchain Law in Liechtenstein.

“Blockchain technology” was initially developed for Bitcoin, a private digital monetary system. Blockchain technology functions as a ledger that can securely record financial transactions. The technology can be used for much more than Bitcoin. Blockchain technology has been developed by a number of people and organisations around the world and expanded to other application areas.

Blockchain technology is important because of its ability to record “assets” such as money digitally, preventing these assets from being copied or manipulated and ensuring that they can be transferred securely between different people. The security of such transactions is ensured not by a complex organisation but rather through purely mathematical procedures (e.g. encryption technology, cryptography) and defined rules. Blockchain infrastructure is typically provided online and is available to a broad range of private individuals and companies.

The possibilities presented by blockchain technology are not merely limited to simple transfers of money between private individuals. The technology offers the opportunity for a broad range of financial services. This is noteworthy because it means the creation of digital recording of money or assets and the possibility of conducting transactions with no direct intermediary responsible. Thus, companies offering financial services on blockchain systems use generally available digital infrastructure for assets to provide their services. There are already a number of companies that offer services on the various blockchain systems available today, such as digital wallets, custodial services for crypto-currencies, exchanges for crypto-currencies, and issuing and trading crypto-securities. Blockchain technology is also used for so-called “initial coin offerings” (ICOs), which represents a new way of funding companies or projects. However, it is likely that it will be possible in future to record a much broader range of assets and other rights on blockchain systems and that a number of services related to these rights will be offered. In particular, the low costs for digital transactions will, according to experts, open up new opportunities in fields such as financial services, mobility, energy, industry, media, and many more. These applications are grouped together under what is called the “token economy”.

Because of the rapid pace of development of blockchain technology and its areas of application, it is very important to draft a law abstractly enough to ensure that it remains applicable for subsequent technology generations. That is why the term “transaction systems based on trustworthy technologies (TT systems)” is used for blockchain systems in this Law.

The increasing propagation of blockchain applications has already shown problematic areas, such as open questions related to customer and asset protection as well as the misuse of this technology for money laundering or other criminal purposes. Such issues should be addressed by means of clear regulations. Because blockchain technology is also actively used in Liechtenstein, the government aims to use this Law to clarify the applicable requirements for important activities on blockchain systems in order to improve customer protection and reduce potential reputation risks for Liechtenstein.

In addition, there is currently legal uncertainty regarding business models based on TT systems, which are not subject to financial market legislation, but which involve activities that are very similar to those in the financial sector. With the TTAct, the government aims to define the minimum requirements for these activities on TT systems and have them registered by the FMA.

The legal classification of elements on TT systems is another focus of this draft. With the “token”, the TT-Act introduces a new construct so as to enable the transition of the “real” world to TT systems in a legally secure manner and thus tap the full potential of the token economy. The introduction of the legal construct of the token in Liechtenstein Law makes it necessary to also define other legal aspects, such as ownership, possession and transfer.

To be able to shift the representation of securities from physical certificates to tokens on a TT system, the legal concept of uncertificated rights will be introduced in Liechtenstein Law and, simultaneously, an interface created between securities law and the TT-Act. Uncertificated rights are dematerialised securities which are recorded in a book-entry register rather than being issued as a certificate.

In addition, the TT-Act defines minimum requirements for a TT system in order to increase the efficiency of the token economy by building trust among users.

Because of the enormous potential of the “token economy” for large parts of the economy, the government wants with this Law to increase legal certainty for users and service providers to support the positive development of the token economy in Liechtenstein. By doing so, the government is also responding to the needs of market participants for greater legal certainty in connection with TT systems.

Source: CryptoPlace.li

TRENDS IN THE FINANCIAL TECHNOLOGY MARKET: DELOITTE

Private financial technologies as a tool for sustainable business development in Russia and Kazakhstan.

In 2018, Deloitte, the CIS conducted a comprehensive independent study on the trends in the financial technology market in Russia and Kazakhstan. The development of the Fintech market is primarily stimulated by three fundamental factors:

a) growing demand - the growing demand for financial services received by both the public and business through the Internet or mobile communications;

b) regulator's activity is the activity of the authorities, as a result of which a single national fintech space and infrastructure is formed;

c) dynamic supply - high sensitivity of FINTECH companies to growing demand (regular entry to the market of new products and services).

Currently, the concentration of demand from consumers of FINTECH services falls on the online lending segment. It is one of the most growing in the financial technology market: so, according to experts, in 2017, online companies issued 67% of loans more than a year ago. It should be noted that the absolute majority of representatives of the Fintech market expect the positive dynamics to remain in the online lending segment (two years to come) and consider online lending to be one of the main drivers of the development of the financial technology market...

Source: Deloitte CIS.

ARTICLES ON SECURITYLAB.RU

The leading information security portal SecurityLab.ru has published a note - Cryptocurrency on guard - Sentinel Protocol (2018/11/29).

While the basic technology of Blockchain has already earned an excellent reputation for its high level of security, cryptocurrency assets continue to be stolen daily. Cryptoexchange and wallets today have limited capabilities to prevent users from receiving or sending cryptocurrency funds to malicious addresses or to detect malicious URLs associated with phishing and malware.

The rapid development of computer technology in the 21st century has led to the manifestation of complex and intellectual threats that hinder the further introduction of innovations. Although the essence of cryptocurrency is decentralization, it has also become their biggest weakness. Since in a decentralized cryptocurrency system there is no protection against threats, the burden of security still falls on the shoulders of individuals and corporations. The Sentinel Protocol eliminates the disadvantage of decentralization, turning it into a security advantage. Using the collective intelligence, created by using the decentralization capabilities, Sentinel Protocol combines cryptographic functions and intelligent threat analysis algorithms to create a safe innovation ecosystem.

Let's take a closer look at the Sentinel Protocol platform. So, there are three main security issues that the average cryptocurrency user faces: the first problem is that ordinary users are too easily compromised. The second problem is that, although attackers can often identify victims, users cannot easily identify them. Finally, the damage caused by the attacking users is their personal responsibility...

Source: SecurityLab.ru

Source: K4Y0T Project.

REGULATIONS ON ACTIVITIES WITH TOKENS APPROVED

The Supervisory Board of the High-Tech Park in Belarus approved regulations on the activities of residents of the High-Tech Park with digital signs (tokens).

Source: Belarus Hi Tech Park.

CRYPTOCOMPARE PUBLISHES LATEST MONTHLY EXCHANGE REVIEW

London, 6 November 2018: CryptoCompare, the global cryptocurrency market data provider, today published its monthly Exchange Review for October 2018, designed to offer institutional and retail investors insights into the cryptocurrency exchange industry.

The monthly review includes exchange trade data; order book and web traffic analysis; news highlights; exchange market segmentation; an overview of trans-fee mining and decentralised exchanges; information on volumes and pairs including Bitcoin to Fiat volumes; as well as exchange security and KYC requirements.

The Methodology: CryptoCompare’s Monthly Exchange Review evaluates the consistency and quality of exchange data, which is incorporated into CryptoCompare’s real-time Aggregate Index Methodology (the CCCAGG), used to calculate the best price estimation of cryptocurrency pairs traded across global exchanges. It aggregates transactional data from more than 70 exchanges using a 24-hour volume weighted average for every cryptocurrency pair. Constituent CCCAGG exchanges are reviewed and amended each month to ensure that the most representative and reliable market data is used in CCCAGG pair pricing calculations.

Key findings from the October review include:

- The top exchange by 24h spot trading volume was Binance with an average of just under 980 million USD, followed by OKEX and Bitfinex with volumes of 405 million and 368 million respectively.

- Spot volumes constituted less than three quarters of total market volumes on average (less than 7 billion USD) compared to futures volumes (3.2 billion USD). Within total spot volumes, exchanges with taker fees represent approximately 90% of the exchange spot market volumes, while transaction-fee based (TFM) and no-fee exchanges represent the remaining 10%.

- Bithumb saw a 356% spike in trading volumes from an average of 140 million USD to an average of 640 million USD after the 7th of October. This follows after the Singapore-based BK Global Consortium bought a controlling share in the exchange.

- Bitfinex saw a spike in volumes towards the 15th of October as the Bitcoin premium on Bitfinex vs Coinbase reached an all-time high of 11.28%.

- An analysis of the top 100 exchanges by 24h volumes suggests that a third of top exchanges store the vast majority of users’ funds in cold wallets (offline).

- If we look at the ratio of order book depth down to volume, we can rank exchanges by how immune to manipulation their markets might be. What we find is that, itBit, Kraken and Bitstamp have relatively more stable markets compared to exchanges such as CoinEx, ZB and Coinbene.

- CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges in the top 25. This may point to algorithmic trading, given its almost 176 thousand trades a day at an average trade size of 125 USD. In contrast, Bithumb and HuobiPro had an average trade size of just under 3,000 and 1,500 USD respectively and significantly lower trades per day (12–18 thousand).

- According to a web traffic analysis using Alexa data, exchanges ZB and EXX showed significantly lower daily visitors relative to other exchanges with similar volumes. Both exchanges trade volumes in excess of 150 million USD per day, but attract no more than 700 visitors per day.

Source: CryptoCompare.com

SENTINEL PROTOCOL LAUNCHES THE INTERACTIVE COOPERATION FRAMEWORK API

Solution to protect crypto assets by fighting fraud, scams, and malicious threats.

Singapore, 29 October 2018 — Sentinel Protocol announces the launch of the Interactive Cooperation Framework API (ICF API). After the successful launch of the UPPward Chrome Extension, a crypto scam protection solution, Sentinel Protocol continues to lead the crypto security industry by arming crypto exchanges and wallet services with its ICF API.

The new ICF API is designed to be integrated with financial software applications to proactively protect crypto assets belonging to organizations and clients from malicious threats. Before completing a transaction, the ICF API enables a financial application to query Sentinel Protocol’s Threat Reputation Database (TRDB) and check whether or not a specific crypto wallet address, URL, domain, or Telegram ID is safe. Within milliseconds, the TRDB sends a response. Depending on the type of response, a pending transaction can be immediately rejected and terminated; an alert or warning could be generated; or the transaction could be allowed if the alert level is low.

The key features of the ICF API are:

- Platform agnostic — can be used by any exchange, wallet, DApp, or application.

- Online access to collective security intelligence data held in the TRDB.

- Validated whitelists and blacklists of crypto wallet addresses, URLs, and domains related with malware, phishing, and scams.

While blockchain’s core technology has earned an excellent reputation for strong security, cryptocurrency assets continue to be stolen on a daily basis. Crypto exchanges and wallet services today have limited capabilities for preventing users from accepting or sending crypto funds to malicious addresses or for identifying malicious URLs associated with phishing and malware.

To address the above needs, the ICF API beta version will be made available to organizations by the end of October for testing and evaluation. The full production version will be deployed in early 2019.

Sentinel Protocol, is the world’s first crowd-sourced threat intelligence platform utilizing the advantages of decentralization to protect cyberspace with blockchain security. It aims to equip individuals and organizations with cybersecurity solutions that protect their valuable cryptocurrency assets from malicious threats, attacks, and fraud. Sentinel Protocol is headquartered in Singapore and has offices in Seoul, South Korea and Tokyo, Japan.

Source: Medium.

ARTICLES ON SECURITYLAB.RU

The leading information security portal SecurityLab.ru has published a note - Fighting cryptocurrency crime (2018/11/12).

The rapid development of technology promises not only great profits, but also carries significant risks. The situation with the fraud associated with the turnover of cryptocurrency and tokens (other digital assets) is aggravated.

As soon as platforms began to emerge expertise in the field of combating cryptocurrency fraud. Such as platform Crystal Blockchain.

Crystal is the result of two years of work and development by Bitfury Group’s development team. Consisting of world-class blockchain analysts, award-winning mathematicians and professional software developers, united by the idea of using Blockchain technology to build a better, secure future.

They turned this idea into reality, developing best-in-class blockchain solutions for people all over the world ... The results of current investigations and team research are available...

Source: SecurityLab.ru

Source: K4Y0T Project.

COINGECKO QUARTERLY REPORT Q3 2018

The full Q3 2018 Cryptocurrency Report by CoinGecko. Top highlights of the report: market dynamics and yearly market overview.

Total market capitalization has carried on its decline from Q2. Despite the downward pressure, market capitalization has been relatively stable in Q3 with trading volume growing.

Exchanges implementing trans-fee mining was a big trend in Q3. Trans-fee mining is the "mining" or creation of new exchange-based tokens via rebates of the exchange's transaction fees. The introduction of trans-fee mining have significantly changed the dominance rank for cryptocurrency exchanges in Q3 as compared to Q2.

A majority of news updates in Q3 relates to government regulation and mainstream adoption of blockchain technology. There is significantly less chatter around new ICO projects.

Despite the bearish market sentiment, there are still many project that attempted to raise funds via ICO. However, only half of them manage to complete their ICO with the average amount raised decreasing from $10.4 million in Q2 to $8.2 million in Q3.

CoinGecko collaborated with Masternodes.Online to produce a quarterly special with an insight into the growing masternodes space. The number of masternodes have been steadily increasing as investors seek alternative investment in this bearish market.

CoinGecko collaborated Nonfungible.com to take a deeper look into Non-Fungible Tokens (NFT). With the introduction of Cryptokitties and the introduction of the ERC-721 standard, NFT have gain significant popularity in 2018 with transaction volume doubled between January and October 2018.

Source: CoinGecko: 360° Market Overview of Coins & Cryptocurrencies.

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su