INDUSTRY REPORTS (31)

Reports of analytical and consulting companies.

INITIAL COIN OFFERINGS (ICO'S) FOR SME FINANCING

Written by Aleksandr Podobnykh15 January 2019 - Initial Coin Offerings (ICOs) are one of the most prominent applications of blockchain for finance, allowing for an innovative and inclusive way of financing small and medium-sized enterprises (SMEs).

Although the lack of regulatory clarity currently exposes ICO participants to some risks, appropriately regulated and supervised ICOs offer a potential new way to raise capital for projects enabled by Distributed Ledger Technologies and the blockchain.

This report analyses the emergence and potential of ICOs as a financing mechanism for start-ups and SMEs, examines the benefits and challenges of this mechanism for small businesses and investors, and discusses the policy implications of ICO activity for the inclusive financing of SMEs and the real economy...

Source: OECD.

CRYPTO CRIME REPORT: DECODING HACKS, DARKNET MARKETS, AND SCAMS

Written by Bederov IgorReleased today, Chainalysis latest crypto crime research on $1.6B in hacks, darknet market activity, and Ethereum scams shows how they decoded each type of crime and what it means for AML compliance and investigations.

Crypto crime increased in 2018, but it made up a smaller slice of a much larger market. Indeed, according to they analysis, illicit transactions comprised less than 1% of all economic bitcoin activity in 2018, down from 7% in 2012.

Even so, crime remains a significant problem in the cryptocurrency ecosystem. Exchange hacks have generated billions of dollars in criminal proceeds, darknet market activities have netted hundreds of millions of dollars in illicit revenues, and scams targeting individuals have stolen tens of millions of dollars.

Moreover, criminal use of cryptocurrencies has become far more sophisticated. As a result, in this second edition of their Crypto Crime Report, they go deeper in analysis to seek out granular insight into three categories of criminal activity.

Then, they examine the surprising resilience of darknet markets as law enforcement takes aggressive action against them. In a report on the “whack-a-mole” problem with the darknet, they look at how transaction activity briefly subsides then quickly reroutes itself to new platforms when major darknet markets are closed down.

They also examine changing trends in Ethereum scams, where individuals are targeted, as last year’s phishing schemes lose their effectiveness and more complex Ponzi and ICO exit scams emerge to make outsized gains.

Finally, they discuss the role of cryptocurrency in the broader context of money laundering and highlight the importance of different types of services that are used to integrate illicit cryptocurrency into the clean economy...

Source: Chainalysis Research.

BLOCKCHAIN TECHNOLOGY DIGEST: JANUARY 2019

Written by Aleksandr PodobnykhMind Smith has prepared an overview of key materials, analytical reports, research, reports and research articles. All the most interesting in the industry for the month...

37 analytical studies and reports, 27 scientific articles, 5 documents of international organizations.

Since 2018, Mind Smith has been implementing strategic blockchain consulting. Helps answer the question about the use of technology blockchain in business, conducts research and strategic sessions for top managers.

The company believes in the blockchain technology, but understand its limitations. For effective implementation of a well-coordinated work of the business and technical team. Mind Smith is ready to go all the way from the search for possible scenarios and the preparation of the concept to the implementation of the pilot and the implementation of the solution in the business.

We are proud to present the single, most comprehensive data-driven analysis on European technology today.

What’s changed for European tech in the past 12 months? It’s been another record year for investment in European tech and the sector is powering growth in Europe’s stagnant economy. Yet not everyone is benefitting from the boom. The gains are not being democratized by investors. Companies need to address diversity and inclusion tools and unlock hidden talent pools.

This is the fourth edition of the State of European Tech report, the single, most comprehensive data-driven story of European technology today. We’ve gathered data from world-class data partners and a survey of 5,000 members of the tech ecosystem, from founders to students, investors to researchers. We’ve tried to tell the most important stories. We cover diversity and inclusion, talent, regulation, investment, research and development, and the great, global disrupters out of Europe...

Source: State of European Tech 2018.

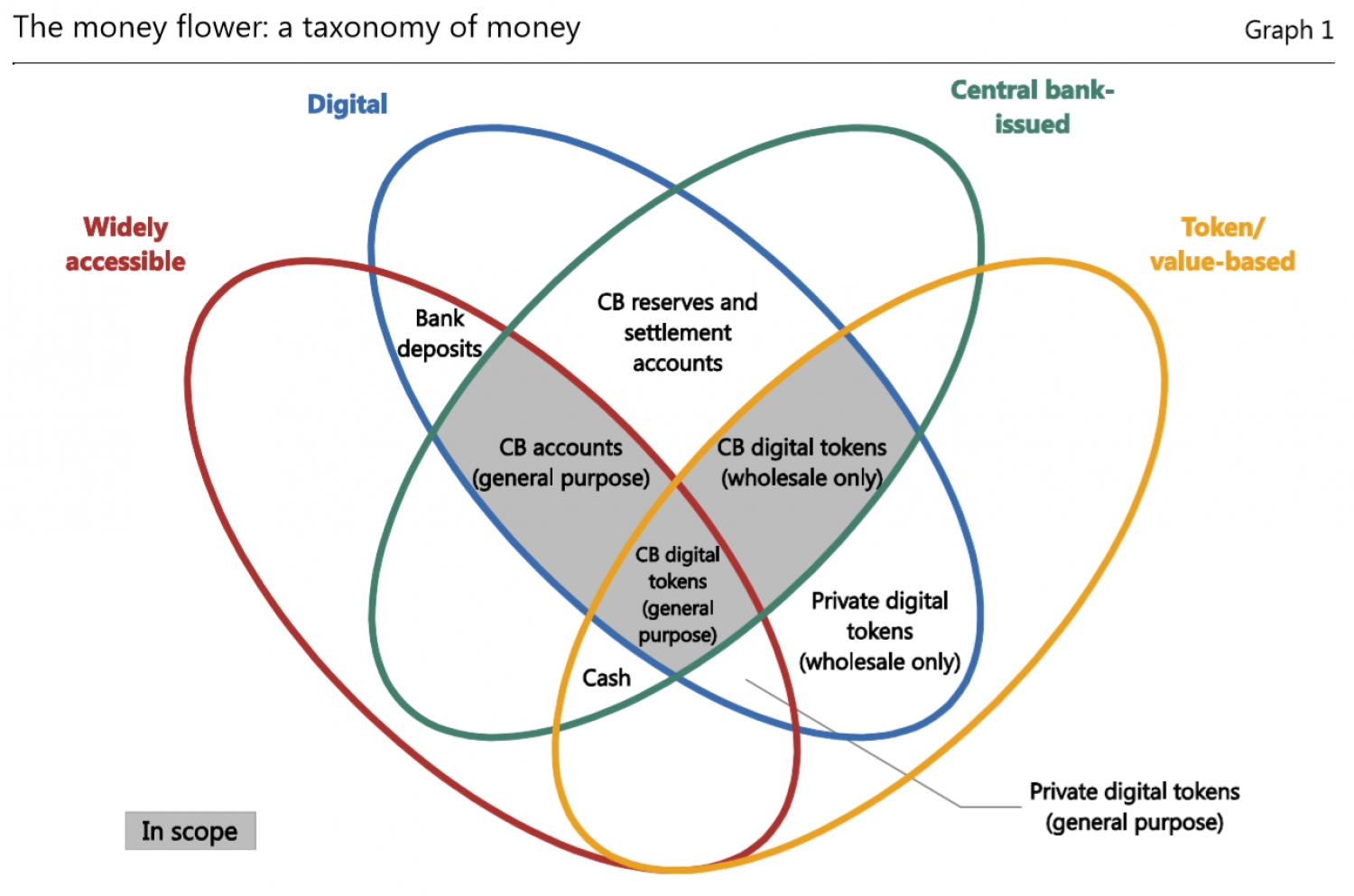

PROCEEDING WITH CAUTION - A SURVEY ON CENTRAL BANK DIGITAL CURRENCY: BIS

Written by Aleksandr PodobnykhOn January 8, Bank For International Settlements released BIS Papers № 101, written by By Christian Barontini and Henry Holden.

The hypothetical benefits and risks of central bank digital currencies are being widely discussed. This BIS paper adds to these discussions by taking stock of how progress and plans in this area are developing, based on a global survey of central banks. Responses show that central banks are proceeding with caution and most are only at a conceptual stage with their work. However, a handful have moved to considering practical issues and a couple of central banks with idiosyncratic circumstances might issue a digital currency in the short or medium term.

Source: Bank for International Settlements.

UNITED KINGDOM'S MEASURES TO COMBAT MONEY LAUNDERING AND TERRORIST FINANCING

Written by Aleksandr PodobnykhParis, 7 December 2018 - The United Kingdom has a well-developed and robust regime to effectively combat money laundering and terrorist financing. However, it needs to strengthen its supervision, and increase the resources of its financial intelligence unit.

The FATF has conducted an assessment of the United Kingdom’s anti-money laundering and counter terrorist financing (AML/CFT) system. The assessment is a comprehensive review of the effectiveness of the UK’s measures and their level of compliance with the FATF Recommendations.

The UK is the largest financial services provider in the world. As a result of the exceptionally large volume of funds that flows through its financial sector, the country also faces a significant risk that some of these funds have links to crime and terrorism. This is reflected in the country’s strong understanding of these risks, as well as national AML/CFT policies, strategies and proactive initiatives to address them.

The UK aggressively pursues money laundering and terrorist financing investigations and prosecutions, achieving 1400 convictions each year for money laundering. UK law enforcement authorities have powerful tools to obtain beneficial ownership and other information, including through effective public-private partnerships, and make good use of this information in their investigations. However, the UK financial intelligence unit needs a substantial increase in its resources and the suspicious activity reporting regime needs to be modernised and reformed.

The country is a global leader in promoting corporate transparency and it is using the results of its risk assessment to further strengthen the reporting and registration of corporate structures. Financial institutions as well as all designated non-financial businesses and professions such as lawyers, accountants and real estate agents are subject to comprehensive AML/CFT requirements. Strong features of the system include the outreach activities conducted by supervisors and the measures to prevent criminals or their associates from being professionally accredited or controlling a financial institution. However, the intensity of supervision is not consistent across all of these sectors and UK needs to ensure that supervision of all entities is fully in line with the significant risks the UK faces.

The UK has been highly effective in investigating, prosecuting and convicting a range of terrorist financing activity and has taken a leading role in designating terrorists at the UN and EU level. The UK is also promoting global implementation of proliferation-related targeted financial sanctions, as well as achieving a high level of effectiveness in implementing targeted financial sanctions domestically.

The UK’s overall AML/CFT regime is effective in many respects. It needs to address certain areas of weakness, such as supervision and the reporting and investigation of suspicious transactions. However, the country has demonstrated a robust level of understanding of its risks, a range of proactive measures and initiatives to counter the significant risks identified and plays a leading role in promoting global effective implementation of AML/CFT measures.

FATF adopted this report at its Plenary meeting in October 2018...

Blockchain, a revolutionary basis for decentralized online transactions, carries security risks. Learn about current security problems and specific incidents within blockchain implementations, and the techniques, targets, and malware used for attacks.

What spiked the movement, starting in fall 2017, toward cryptojacking? The first reason is the value of cryptocurrency. If attacker can steal Bitcoins, for example, from a victim’s system, that’s enough. If direct theft is not possible, why not mine coins using a large number of hijacked systems. There’s no need to pay for hardware, electricity, or CPU cycles; it’s an easy way for criminals to earn money. We once thought that CPUs in routers and video-recording devices were useless for mining, but default or missing passwords wipe away this view. If an attacker can hijack enough systems, mining in high volume can be profitable. Not only individuals struggle with protecting against these attacks; companies suffer from them as well...

CRYPTOCURRENCY ANTI-MONEY LAUNDERING REPORT - Q3 2018

Written by Aleksandr PodobnykhCipherTrace Third Quarter Report proves cryptocurrency anti-money laundering laws are effective, and cites $927 million of cryptocurrency stolen during 2018 that needs to be laundered.

Ninety-Seven Percent (97%) of Criminal Bitcoin Flows into Unregulated Cryptocurrency Exchanges According to New Research...

October 10, 2018 – Efforts to enact and enforce strong cryptocurrency Anti-Money Laundering (AML) regulations are drastically reducing criminal activity on digital currency exchanges, according to new research released today in the CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report. The study revealed that 97 percent of direct bitcoin payments from criminals went to exchanges in countries with weak anti-money laundering laws.

Nearly five percent of all bitcoin sent to poorly regulated exchanges comes from criminal activity before the money is moved, undetected, into the global financial payments system. In fact, these exchanges have laundered a significant amount of bitcoin, totaling 380,000 BTC or $2.5 billion at today’s prices.

The report covers the latest legislative changes, as governments around the world are ramping up cryptocurrency AML regulation and enforcement, many by the end of this year. For example, US FinCEN recently clarified its stance on regulation, subjecting crypto-to-crypto exchanges to the Bank Secrecy Act (BSA) rules, focusing on mixing services and enlisting the help of the IRS. The European Commission’s 5th Anti-Money Laundering Directive (AMLD 5) was also entered into force in July and will require G20 nations to comply with strict AML regulations. “Different geographies are competing on regulations and trying to become ‘trusted’ digital currency hubs in order to grow their economies,” added Jevans.

During the first three quarters of this year, the report shows $927 million of cryptocurrency reported as stolen from exchanges. The $166 million in reported thefts since the second quarter report was driven by an emerging trend toward more frequent and smaller cyberattacks by sophisticated thieves. CipherTrace estimates that total stolen cryptocurrency reported is expected to hit well over $1 billion by the end of the year – currency that needs to be laundered.

The CipherTrace 2018 Q3 Cryptocurrency Anti-Money Laundering Report provides an in-depth state-of-the-market look at criminal activity and the status of AML regulations by jurisdiction. The report presents an unprecedented quantitative analysis of 45 million transactions at 20 top cryptocurrency exchanges globally between January 2009 until September 20, 2018, and identifies criminal funds from dark markets, extortion, malware, mixer/tumbler/money laundering sites, ransomware, and terrorist financing.

Source: CipherTrace.

TRENDS IN THE FINANCIAL TECHNOLOGY MARKET: DELOITTE

Written by Aleksandr PodobnykhPrivate financial technologies as a tool for sustainable business development in Russia and Kazakhstan.

In 2018, Deloitte, the CIS conducted a comprehensive independent study on the trends in the financial technology market in Russia and Kazakhstan. The development of the Fintech market is primarily stimulated by three fundamental factors:

a) growing demand - the growing demand for financial services received by both the public and business through the Internet or mobile communications;

b) regulator's activity is the activity of the authorities, as a result of which a single national fintech space and infrastructure is formed;

c) dynamic supply - high sensitivity of FINTECH companies to growing demand (regular entry to the market of new products and services).

Currently, the concentration of demand from consumers of FINTECH services falls on the online lending segment. It is one of the most growing in the financial technology market: so, according to experts, in 2017, online companies issued 67% of loans more than a year ago. It should be noted that the absolute majority of representatives of the Fintech market expect the positive dynamics to remain in the online lending segment (two years to come) and consider online lending to be one of the main drivers of the development of the financial technology market...

Source: Deloitte CIS.

INSTITUTIONALIZATION OF CRYPTOASSETS: KPMG

Written by Rytikov AleksanderCryptoassets have arrived, but what will it take to secure their future? Institutionalization, says KPMG report from 15 November 2018.

Key challenges remain including cyber security, regulatory compliance, fork management and accounting.

The future success of cryptoassets will depend on the ability to institutionalize them by building trust and facilitating scale, with participation from both traditional and emerging players within the global financial services ecosystem, says a new report, Institutionalization of Cryptoassets from KPMG, with contributions from Coinbase and other industry companies.

The report points out that recently there has been a wave of new entrants in the market, such as established financial services institutions, security token platforms and crypto exchanges, who are launching various crypto products and services for the emerging blockchain-based tokenized economy. It suggests the tokenized economy will likely be one of the more significant innovations enabled by crypto.

Authors of the paper also suggest that crypto represents an opportunity to potentially transform the financial services sector and create a truly open global financial system.

The report takes an in-depth look at some of the key challenges facing crypto including:

- compliance with regulatory obligations;

- know your customer (KYC) and asset provenance;

- securing cryptoassets;

- accounting and financial reporting;

- tax implications;

- fork management and governance.

The report says of the 2,000 plus cryptoassets issued or mined, many, including those with high valuations, don't have a functional product associated with them.

Is crypto a solution looking for a problem? No, there are real problems that cryptoassets are looking to address and their staying power will be defined by their ability to reduce friction and inefficiencies that currently exist within the global economy.

Read the report...

Source: KPMG International.

More...

CRYPTOCOMPARE PUBLISHES LATEST MONTHLY EXCHANGE REVIEW

Written by Aleksandr PodobnykhLondon, 6 November 2018: CryptoCompare, the global cryptocurrency market data provider, today published its monthly Exchange Review for October 2018, designed to offer institutional and retail investors insights into the cryptocurrency exchange industry.

The monthly review includes exchange trade data; order book and web traffic analysis; news highlights; exchange market segmentation; an overview of trans-fee mining and decentralised exchanges; information on volumes and pairs including Bitcoin to Fiat volumes; as well as exchange security and KYC requirements.

The Methodology: CryptoCompare’s Monthly Exchange Review evaluates the consistency and quality of exchange data, which is incorporated into CryptoCompare’s real-time Aggregate Index Methodology (the CCCAGG), used to calculate the best price estimation of cryptocurrency pairs traded across global exchanges. It aggregates transactional data from more than 70 exchanges using a 24-hour volume weighted average for every cryptocurrency pair. Constituent CCCAGG exchanges are reviewed and amended each month to ensure that the most representative and reliable market data is used in CCCAGG pair pricing calculations.

Key findings from the October review include:

- The top exchange by 24h spot trading volume was Binance with an average of just under 980 million USD, followed by OKEX and Bitfinex with volumes of 405 million and 368 million respectively.

- Spot volumes constituted less than three quarters of total market volumes on average (less than 7 billion USD) compared to futures volumes (3.2 billion USD). Within total spot volumes, exchanges with taker fees represent approximately 90% of the exchange spot market volumes, while transaction-fee based (TFM) and no-fee exchanges represent the remaining 10%.

- Bithumb saw a 356% spike in trading volumes from an average of 140 million USD to an average of 640 million USD after the 7th of October. This follows after the Singapore-based BK Global Consortium bought a controlling share in the exchange.

- Bitfinex saw a spike in volumes towards the 15th of October as the Bitcoin premium on Bitfinex vs Coinbase reached an all-time high of 11.28%.

- An analysis of the top 100 exchanges by 24h volumes suggests that a third of top exchanges store the vast majority of users’ funds in cold wallets (offline).

- If we look at the ratio of order book depth down to volume, we can rank exchanges by how immune to manipulation their markets might be. What we find is that, itBit, Kraken and Bitstamp have relatively more stable markets compared to exchanges such as CoinEx, ZB and Coinbene.

- CoinEx, a well-known trans-fee mining exchange, has a significantly higher trade frequency and lower trade size than other exchanges in the top 25. This may point to algorithmic trading, given its almost 176 thousand trades a day at an average trade size of 125 USD. In contrast, Bithumb and HuobiPro had an average trade size of just under 3,000 and 1,500 USD respectively and significantly lower trades per day (12–18 thousand).

- According to a web traffic analysis using Alexa data, exchanges ZB and EXX showed significantly lower daily visitors relative to other exchanges with similar volumes. Both exchanges trade volumes in excess of 150 million USD per day, but attract no more than 700 visitors per day.

Source: CryptoCompare.com

REGULATION IN CRYPTOINDUSTRY: STATUS, STRATEGIES AND EFFECTS

Written by Lipilin Vladimir2018 can be designated the year of regulation of the cryptoindustry. Most countries of the world create working groups for the development of laws, and in some cases adopt full-fledged bills to regulate the actions of participants in the cryptoindustry.

This report (from October 31, 2018) is the first in a series of reports by the Center for Financial Innovations and Non-Cash Economy of the Moscow School of Management SKOLKOVO on cryptoindustry. It analyzes the global experience of crypto regulation and classifies possible regulatory strategies. The report will be useful not only to regulatory and state bodies, but also to other participants of the cryptoeconomy ecosystem: business representatives lobbying regulatory initiatives, companies that are actively involved in the cryptoindustry and are engaged in crypto-activity, individuals considering trading on both amateur and professional and to all who are interested in the global development of the cryptoindustry.

Source: Moscow School of Management SKOLKOVO.

The full Q3 2018 Cryptocurrency Report by CoinGecko. Top highlights of the report: market dynamics and yearly market overview.

Total market capitalization has carried on its decline from Q2. Despite the downward pressure, market capitalization has been relatively stable in Q3 with trading volume growing.

Exchanges implementing trans-fee mining was a big trend in Q3. Trans-fee mining is the "mining" or creation of new exchange-based tokens via rebates of the exchange's transaction fees. The introduction of trans-fee mining have significantly changed the dominance rank for cryptocurrency exchanges in Q3 as compared to Q2.

A majority of news updates in Q3 relates to government regulation and mainstream adoption of blockchain technology. There is significantly less chatter around new ICO projects.

Despite the bearish market sentiment, there are still many project that attempted to raise funds via ICO. However, only half of them manage to complete their ICO with the average amount raised decreasing from $10.4 million in Q2 to $8.2 million in Q3.

CoinGecko collaborated with Masternodes.Online to produce a quarterly special with an insight into the growing masternodes space. The number of masternodes have been steadily increasing as investors seek alternative investment in this bearish market.

CoinGecko collaborated Nonfungible.com to take a deeper look into Non-Fungible Tokens (NFT). With the introduction of Cryptokitties and the introduction of the ERC-721 standard, NFT have gain significant popularity in 2018 with transaction volume doubled between January and October 2018.

Source: CoinGecko: 360° Market Overview of Coins & Cryptocurrencies.

SEC ENFORCEMENT DIVISION ISSUES REPORT ON FY 2018 RESULTS

Written by Rytikov AleksanderThe Securities and Exchange Commission’s Enforcement Division issued the annual report of its ongoing efforts to protect investors and market integrity, Nov. 2, 2018. The report also highlights several significant actions and initiatives that took place in FY 2018. The report presents the activities of the Division from both a qualitative and quantitative perspective.

In accordance with Chairman Clayton’s charge to focus on Main Street investors, Division of Enforcement Co-Directors Stephanie Avakian and Steven Peikin previously outlined five core principles that serve to guide the work of the division.

The core principles – focus on the Main Street investor, focus on individual accountability, keep pace with technological change, impose remedies that most effectively further enforcement goals, and constantly assess the allocation of resources – were first described in the Division’s FY 2017 annual report. The Division’s adherence to these principles resulted in meaningful results, including the return of almost $800 million to harmed investors, holding individuals – including many at the highest level – accountable, barring bad actors from the securities markets, and sending strong messages of deterrence. The impact of these actions has unquestionably protected investors of all types, particularly retail investors.

The Division’s focus on obtaining relief for harmed investors is underscored by various retail investor-specific initiatives. One example is the Division’s Share Class Selection Disclosure Initiative, a self-reporting initiative designed to quickly return money to investors who may have been harmed by failures to disclose conflicts of interests related to the selection of mutual fund share classes.

Also illustrative of the Division’s impact in protecting investors and market integrity is the groundbreaking approach to addressing misconduct involving initial coin offerings and digital assets, which reflects a focus on cases that deliver strong and clear messages and have broad market impact.

Quantitatively, the SEC brought a diverse mix of 821 enforcement actions, including 490 standalone actions, and returned $794 million to harmed investors. A significant number of the SEC’s standalone cases concerned investment advisory issues, securities offerings, and issuer reporting/accounting and auditing, collectively comprising approximately 63 percent of the overall number of standalone actions. The SEC also continued to bring actions relating to market manipulation, insider trading, and broker-dealer misconduct, with each comprising approximately 10 percent of the overall number of standalone actions, as well as other areas. And it obtained judgments and orders totaling more than $3.945 billion in disgorgement and penalties...

Source: SEC.gov

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su