Displaying items by tag: SICP

FINMA PUBLISHES STABLE COIN GUIDELINES: EXPERT OPINION

On September 11, 2019, the Swiss financial market supervision authority FINMA published an addendum to the ICO manual, which outlined its position on stablecoin1 under the Swiss supervision legislation. Observing the steady growth of stablecoin projects since 2018, in the context of a request from the Libra Association, FINMA in the initial directions provides information on how the Swiss supervisory will apply the relevant rules for the assessment and supervision of stablecoins.

According to FINMA, the supervisor considers stablecoin in accordance with the law on supervision of an existing approach to blockchain-based tokens: the main focus is on the economic nature and purpose of the token (“substance over form”). When making decisions on specific projects, FINMA will “follow the proven principle of“ same risks, same rules ”, and also take into account the features of each project.

The requirements under the supervision law may vary depending on which assets (e.g. currencies, goods, real estate or securities) are supported by stablecoin and how the legal rights of its owners will be protected (see the Overview in the Appendix to the Guidelines ICO, Appendix 2).

FINMA provided the legal assessment and indicative classification of the Libra project in accordance with Swiss supervisory law based on the available information. It is worth noting that FINMA focused on the fact that the classification may change during the implementation of the project.

Here are a few key points:

- The project falls under the regulation of Swiss financial market infrastructure. The project, as it is currently envisioned, will require a FINMA payment system license.

- The regulatory requirements for payment systems in Switzerland are based on prevailing international standards, in particular, on the Principles for Financial Market Infrastructures (PFMI). These requirements also apply to cyber risk management.

- The Swiss payment system is automatically covered by the Anti-Money Laundering Act. The highest international anti-money laundering standards must be ensured throughout the project’s ecosystem. Such an ecosystem must be protected from the increased risks of money laundering.

- According to the Financial Market Infrastructure Act (FMIA), all additional services that increase the risks of the payment system must comply with the relevant additional requirements. This means that all potential risks of the Swiss payment system, including banking risks, can be eliminated by introducing the relevant requirements in accordance with the principle of “same risks, same rules”. In connection with the release of Libra payment tokens, the services planned by the Libra project will clearly go beyond a purely payment system and, therefore, will be the subject of such additional requirements.

- These additional requirements will relate in particular to the distribution of capital (for credit, market and operational risks), concentration of risk and liquidity, as well as the management of the Libra reserve.

- Additional requirements will be based on generally accepted standards for similar activities in financial markets and should reflect the scope of the project. For example, for similar banking risks, banking regulatory requirements will apply. Thus, the license of the Swiss payment system will allow you to combine the strengths of banking and infrastructure regulation.

A prerequisite for obtaining a license as a payment system would be that the revenues and risks associated with the management of the reserve are fully covered by the Libra Association, and not by the providers of funds - stablecoin holders.

The planned international scope of the project requires an internationally coordinated approach. In particular, the definition of requirements for reserve management and management, as well as for combating money laundering, should be developed in the framework of international coordination.

Matters beyond supervisory law.

A possible licensing procedure under Swiss supervision legislation will only begin after FINMA receives a specific licensing application. In accordance with its practice, FINMA will not provide public information on the status of any existing licensing procedures and will not speculate on when it may be completed.

Other issues raised in the context of the Libra project, such as those related to tax law, competition law or data protection law, are outside the scope of supervisory law and therefore are not within the competence of FINMA.

In the next message, we will analyze in detail the documents posted below.

Source: FINMA.

CRYPTO-AFFAIR OF THE CENTURY: PLUSTOKEN INVESTORS LOST $ 3 BILLION

PlusToken crypto wallet, which proposed storing almost all the world's leading cryptocurrencies and making a profit on their investments, can claim the status of the largest fraudulent project in the history of financial pyramids. Users cannot withdraw the equivalent of $ 3 billion from their online wallets.

PlusToken, an international decentralized crypto project of the multi-currency online wallet PlusToken, was launched in April 2018. The project was positioned by the creators as developing a team from South Korea using Samsung technology. The marketing campaign was launched in Asia (China, Japan, South Korea, Myanmar, Vietnam), a number of European countries (Germany and the UK), as well as in Russia.

In addition to the ability to store almost all the world's leading cryptocurrencies in the wallet - Bitcoin, Bitcoin Cash, Ethereum, XRP, EOS, IO, Litecoin, Doge and Dash, users were promised a fairly significant return on investment of their cryptocurrency assets - from 6% to 19% per month.

According to experts from Elementus (USA), a company that creates and promotes fintech solutions based on blockchain technology, over 800 thousand Ethereum cryptocurrency depositors have used PlusToken wallets for the entire existence of the project and stored about 10 million ETH on them.

According to the Special elaborations department of the Technopark of St. Petersburg, the PlusToken pyramid attracted about 200 thousand bitcoins, 789 thousand ETH and 26 million EOSIO. All these funds went to wallets controlled by the PlusToken team.

However, interested media write, these estimates are very preliminary, and the amount collected from investors may be much larger. So, experts say, only the Ethereum address of PlusToken stored more than 781,000 ETH, which, in terms of the exchange rate, amounts to more than $ 234 million.

The capitalization of PlusToken at the top of trading reached $ 17 billion. PlusToken was accused of fraud in March 2019, when Chinese police raided PlusToken's offices in Hunan (PRC). The head of PlusToken's Chinese unit, Chen Bo, as well as five other Chinese citizens related to the cryptocurrency wallet project, have disappeared and are on the wanted list.

Problems with the withdrawal of assets from PlusToken wallets began in late June 2019. The Chinese investors were the first to suffer, as evidenced by the entries in the PlusToken support service, which did not respond to calls, and, starting on June 29, the PlusCoin platform token exchange rate remained at the same level ($ 139,237) without hesitation.

On June 29, according to the Dailypost, six Chinese citizens suspected of participating in an Internet scam were arrested on the island of Vanuatu at the request of the Chinese authorities and deported back to China. It is possible, the publication reports that they are precisely the key figures in the PlusToken team.

To date, it is known that the organizers of PlusToken have already managed to cash out part of the bitcoins through crypto exchanges Huobi Global (Singapore) and Bittrex (USA). In particular, the Singapore cryptocurrency exchange got almost half of the funds raised for wallets - about 4.3 million ETH. The other part was transferred to one of the cryptocurrency wallets.

It was possible to track the funds of defrauded investors thanks to the cryptocurrency transaction analysis service created in the Special elaborations department of the Technopark of St. Petersburg.

According to experts, the obvious signs of the financial pyramid of the PlusToken project were tracked from the very beginning. Among them, the referral system of distribution of funds offered to investors, which is characteristic of financial pyramids and MLM marketing, and unjustifiably high monthly profit (from 6% to 19%.). The PlusToken fraudulent scheme is already being compared with the principles of organizing the BitConnect closed cryptocurrency platform. It entered the market through an ICO at the end of December 2016, and by the end of 2017, its BCC tokens have established themselves as one of the fastest growing cryptocurrencies. She guaranteed her investors a 40% return for a month. According to CoinMarketCap, in a fairly short time, BCC capitalization reached $ 2.6 billion, and the ATH rate was $ 460. But in January 2018, BitConnect unexpectedly for its investors announced the closure of the exchange and the lending program, notifying them that they would continue to provide services as a wallet, but at the same time change the format to a media platform. Immediately after this announcement, investors fell into a panic, and the BCC rate lost 96% of the cost.

It is interesting to note that in Russia until now, users have access to the PlusToken mobile wallet, which can be downloaded from the GooglePlay and AppStore stores. For the storage of their crypto assets in the wallet, Russian investors are still guaranteed a profit of 6% to 19% monthly. True, the “blog” section of PlusToken’s Russian site is currently inactive (or deleted), and all consultations are invited to receive via WhatsApp.

Source: IT News.

SPECIAL ELABORATIONS DEPARTMENT AT TECHNOPARK OF ST. PETERSBURG IS PRESENTED FOR INFINITY GROUP

On September 3, 2019, in St. Petersburg, specialists and residents of the SafeNet RIC of the St. Petersburg Technopark, together with the Russoft NP and Bee Pitron, held a presentation session for the Indian delegation of Infinity Group. The key focus of the event was the creation of a platform for interaction between participants in the Russian-Indian market.

As part of the meeting, Igor Bederov presented the developments of the Special Development Department for a distinguished guest from India. Mr. Darbari drew particular attention to existing developments in the field of cryptocurrency transaction control and crime prevention. According to him, in India, up to 20% of the population and a significant amount of low-level crime use cryptocurrencies. In addition, the country has not resolved the problem of relapse in previously convicted criminals.

Back in July, in the format of the Second Russian-Indian strategic dialogue, in order to establish a technology transfer, an agreement was signed between RUSSOFT and Infinity Group. As a result, the ICT Center of Excellence project was launched in India, designed to establish cooperation between the two countries in the direction of business development and international assistance to SMEs.

The delegation of the Infinity Group, headed by Mr. Darbari, flew to Russia to meet with potential recipients of investments and to transfer technology from Russia to India under the “Made in India” program.

After a tour of the engineering center, SafeNet residents presented their projects in the areas of Artificial Intelligence, Internet of Things, cyberphysical security, blockchain, virtual and augmented reality. The parties discussed the situation on the international high-tech market and considered options for potential mutually beneficial cooperation. ICT experts emphasized the relevance of Russian solutions to the market of India and other countries and discussed the possibility of implementation.

Source: Engineering center SafeNet.

CYBERPOL PUBLIC SEARCH CRIMINAL DATABASE TO INCLUDE CRYPTOCURRENCY WALLETS USED IN CYBERCRIME

BRUSSELS, 1000, BELGIUM, June 18, 2019. CYBERPOL Public Search Criminal Database to include Crypto Currency wallets used in cyber crime.

CYBERPOL The International Cyber Policing Organization established by decree no WL 22/16.595 established today four years ago in Brussels made available to the public the first cyber criminal database empowered by the "Neural symbiotic network of the super computer" as the international cyber utility agency leader in investigation in cyber crimes and terror of the Dark-Web today.

This first Cyber Criminal Public Record Database in Beta Test mode currently will allow four basic levels of searching of wanted cyber criminals allowing for verification and searches of IP's, emails and Cryptocurrency wallets used in on-line scams related to cyber crimes listed in the database.

In addition to this, all cryptowallets using crypto currencies in cybercrime will now be listed on the Cyber Crime search engine by CYBERPOL organization making it very difficult for cyber criminals to use crypto-currencies as payment methods for scams and cyber crimes.

You can now report any scam email to CYBERPOL that when verified will be listed in the CYBERPOL Cyber Criminal Public Database open to public to search.

More than £108,000 in bitcoin was paid by victims of the WannaCry ransomware attacks using bitcoin as undetectable crypto-currency payment. Since such wallets used in crimes are not considered privacy breaches but in the interest of the law it is in the public interest to warn public and make such wallets black listed public records globally before further victims falls pray to cyber crimes Baretzky President of CYBERPOL said.

Public and law enforcement can use this CYBERPOL facilities for free and report such e-mail of extortion to be entered into the public records of CYBERPOL Public Utility directly by requests.

Several entries is already public to search on-line and don't try to fool CYBERPOL. The tracking of cyber crimes goes the extra mile to track the same hackers when visiting the search engine on CYBERPOL website using a new AI (Artificial Intelligence) named 666 to capture both mac and serial number of such computers. Don't be a hackers fool to search yourselves if you are already involved in cyber crimes, the CYBERPOL Spokes Person warned.

This will be a huge blow for crypto currencies and wallets used in cyber crimes and scams as the wallet numbers will be public listed and open to see to all public and law-enforcement free of charges in disrupting cyber crimes.

The message is clear and simple President Ricardo Baretzky of CYBERPOL said "Don't use any Crypto Currencies in INTERNET crimes as we will not only find you but list your crypto WALLET accounts for good in the block-chain based search engine of CYBERPOL Supper Computer AI 666 symbiotic neural network and let me assure all those financial criminals, once listed there is no escape! I hope this message is clear to criminals and corruption".

It seems the days messing with elections using secret corruption payments could be counted as CYBERPOL has set a new paradigm in combating cyber crimes and global corruption never seen before...

Source: EIN Presswire.

IN 2 MONTHS SICP REVEALED 46.000 "UNRELIABLE" BITCOIN WALLETS

In Russia, announced an online service that analyzes the risks of using cryptocurrency and investigates crimes committed in this area. The development was carried out by the company "Internet-Rozysk".

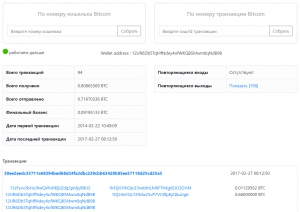

The service, which was launched last year, was called the Security Intelligence Cryptocurrencies Platform. In January, an alpha version of the service appeared on the site www.ueba.su.

According to the project director Igor Bederov, the service was launched in December last year and as of January 2019, he found 46 thousand bitcoin wallets, which were given the status of "unreliable".

SICP analyzes blockchains, websites, chat rooms, and forums to identify those cyberwiches that are used in criminal schemes, such as fraud, blackmail, money laundering, and so on. Also, the development team of the platform builds interactions with market participants, public organizations and law enforcement agencies. One of the promising goals of the service creators see deanonymization of purses and assigning them the status of “trustworthy” - provided that they are not seen in the implementation of suspicious operations, and “unreliable” - if the operations that were carried out through the wallet raise doubts. At this stage, the strategic partners of the project are CipherTrace, Sentinel Protocol, Crystal, CryptoPolice, Wawes, SPb BlockChain, CryptoRussia.ru and ACISO.

The developers set themselves the task of giving users the ability to track all transactions from the moment they are sent until the moment they receive funds on the recipient’s wallet. The system should work by analogy with the methods that are now used by the financial supervision authorities. The service will identify wallets that are used for money laundering, terrorist financing and other illegal purposes. Also, the service will be able to monitor transactions on certain wallets for a long time, which will allow detecting fraudulent ICOs.

SICP is a breakthrough technology for Russian crypto-business. This prominent development will allow participants of the Russian cryptocurrency market to protect themselves from fraud, journalists said.

Note that on pre-sale, SICP tokens can be purchased at half price, and the alpha version of the service from January 9 can be connected to www.ueba.su.

Source: CryptoRussia.ru

ARTICLES ON SECURITYLAB.RU

The leading information security portal SecurityLab.ru has published a note: CipherTrace - audit trail encryption (2018/12/16).

For the first 9 months of 2018, theft in the cryptocurrency industry reached about $ 1 billion...

The October report by CipherTrace shows that the criminals used bitcoin to launder $ 2.5 billion of dirty money. Thus, 380 000 BTC was laundered on cryptocurrency exchanges.

A new study showed that 97% of criminal bitcoins flow into unregulated cryptocurrency exchanges.

Bitcoin's anonymity is a stumbling block for many, almost from the day it appeared. Despite the fact that a number of politicians and experts consider the first digital money to be completely anonymous, yet this is not true. To make a bitcoin transaction, you do not need personal data and the user's address, but information about all operations remains in the public distributed registry. This may allow you to track cash flow.

There are measures that can increase the anonymity of translations. For these purposes, services have been developed - cryptocurrency mixers. For example, you can convert Bitcoin to other cryptocurrencies, and then back. However, even such methods do not make the first cryptocurrency completely confidential. Both the sender and receiver can still be calculated.

It is noteworthy that at the moment, many state and commercial companies have attended to the identification of users. They make a lot of effort to master the methods of computing the identities of those who make suspicious transfers. Therefore, it’s impossible to talk about complete anonymity on the Bitcoin network...

Source: SecurityLab.ru

Source: K4Y0T Project.

FUNCTIONAL TESTING SICP COMMUNITY

Launched a pilot project of the service of evaluating the reliability of cryptowallets and conducting investigations of crimes committed using cryptocurrency.

We invite an active expert community to take part in testing the functional, discussing the sources of events, as well as questions of the legal significance of the evidence collected.

Suggestions (complaints, statements) are accepted in the comments below, to the official mailbox (This email address is being protected from spambots. You need JavaScript enabled to view it.), or you can use the official contact form on the website...

The most active participants will be presented for the award of internal tokens of the SICP platform.

More details: sicp.ueba.su

ANALYTICS ON SECURITYLAB.RU

On the leading portal for information security, Security.Lab.ru published an analytical note - Countering cryptocurrency fraud (2018/10/29).

In the new industry, the use of distributed ledgers and cryptocurrency turnover, a significant number of problems. The industry is still poorly regulated. Some of them are: current global losses from cybercrime - more than $ 500 billion; fraud world losses - more than $ 50 billion; global cybersecurity costs - more than $ 86.4 billion; ten percent of funds for ICO plundered by fraudsters (phishing) - $ 388 million.

Thus, according to PwC, as of August 2018, 15% of companies have already implemented blockchain technology. The growth of a programmable economy is expected to reach $ 3 trillion by the year 2030. In this regard, the fraud has moved into the cryptocurrency sphere, and almost reached its peak...

Source: SecurityLab.ru

Source: K4Y0T Project.

HOW TO BUY SICP TOKENS

To participate in a private pre-ITO platform, you need to purchase SICP tokens - 6hHaSKBVbZhJrAkr7GyvwBG4NhYyfXoDo3UfHTNxFn7x, on the decentralized exchange DEX (Waves - Bitcoin Wallet & Cryptocurrency).

Waves :: Bitcoin Wallet & Cryptocurrency - Download the app.

Waves Platform - Purchase Waves on the platform.

To purchase Waves, you can use a mobile application, a PC client, or even use an online client (in the browser). After that, you will need to go through the registration procedure and keep the keys in a safe place. As a result, a unique wallet number and the DEX exchange, which supports major cryptocurrencies and fiat currencies, will be available.

To replenish the wallet in USD (with a commission of only 1%), you will need to be identified - IDNow.eu.

О КОСАтка

Корпоративная система аналитики Транзакция Криптовалюта Актив - кибербезопасность инфраструктуры блокчейнов и антифрод в криптовалютной сфере (антискам, прозрачность, комплаенс).

Связаться

Российская Федерация, Москва

Тел.: +7 (911) 999 9868

Факс:

Почта: cosatca@ueba.su

Сайт: www.ueba.su